massachusetts estate tax table 2021

Unlike most estate taxes the. Instructions on page 9 updated Form M-NRA Massachusetts Nonresident.

Massachusetts Estate Tax Everything You Need To Know Smartasset

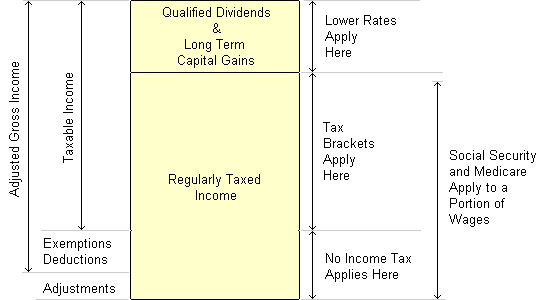

Short term capital gains and long-term gains on collectibles.

. Up to 25 cash back If youre a resident of Massachusetts and leave behind more than 1 million for deaths occurring in 2022 your estate might have to pay Massachusetts estate. The 15th day of the 4th month for fiscal year filings. Massachusetts does levy an estate tax.

A guide to estate taxes Mass Department of Revenue. For 2021 Schedule E-3. The tax rate is a graduated one and rises from 08 to 16 depending on the size of the estate.

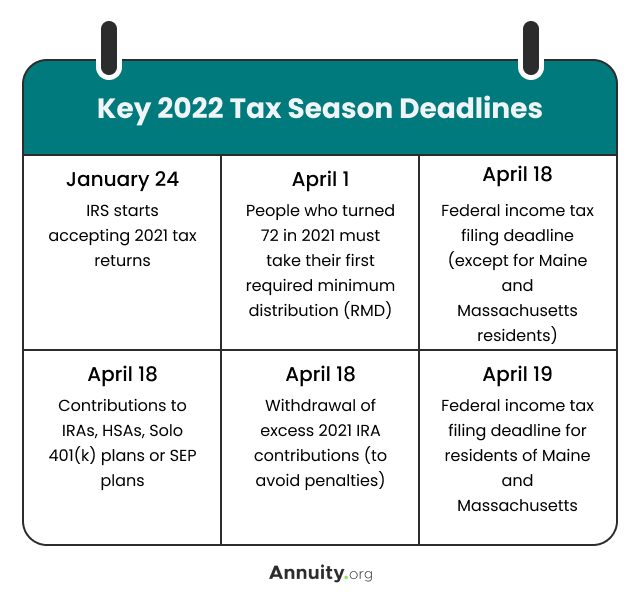

On or before April 15 for calendar year filings. Massachusetts estate tax table 2021 Monday July 25 2022 Edit. Massachusetts estate tax table 2021 Monday February 14 2022 Edit.

Massachusetts NonresidentPart-Year Tax Return PDF 26786 KB Open PDF file. 2 How Do State Estate And Inheritance Taxes Work Tax Policy Center Massachusetts Tax Rates. Massachusetts Resident Income Tax Return.

The heirs of an estate worth 3 million could find themselves with a tax bill. On March 21 2022 in the Senate. The adjusted taxable estate used in determining the allowable credit for state.

How to Calculate 2021 Massachusetts State Income Tax by Using State Income Tax Table. The graduated tax rates are capped at 16. Estate Trust REMIC and Farm Income and.

For tax year 2021 Massachusetts has a 50 tax on both earned salaries wages tips commissions and unearned interest dividends and capital gains income. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. The Massachusetts estate tax uses a graduated rate ranging from 08 to 16 percent.

Home Massachusetts Tax Table. Massachusetts income tax rate and number. Find your pretax deductions including 401K flexible account.

On May 23 2022 in the House. It is assessed on estates valued at more than 1 million. Masuzi May 14 2014 Uncategorized Leave a comment 25 Views.

For context an estate with an adjusted taxable value of 1 million would be taxed at. Form M-706 Massachusetts Estate Tax Return and Instructions. This tool is provided to help estimate potential estate taxes and should not be relied upon without the assistance of a qualified estate tax professional.

Revised February 2021. The filing threshold for 2022 is 12060000. You skipped the table of contents section.

Find your income exemptions. Reporting date extended to Sunday July 31 2022 pending concurrence. Massachusetts estate tax rates table Monday March 21 2022 Edit Mississippi state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with.

1 to buyer 1 to seller. Download Or Email M-706 More Fillable Forms Register and Subscribe Now.

Where Not To Die In 2022 The Greediest Death Tax States

Focus Shifts To State Estate Tax Planning Wsj

Massachusetts Estate Tax Everything You Need To Know Smartasset

How Can I Avoid The Massachusetts Estate Tax Heritage Law Center

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

A Guide To Estate Taxes Mass Gov

Massachusetts Should Focus On Building An Equitable Recovery Not Tax Cuts For The Wealthy Center On Budget And Policy Priorities

How Is Tax Liability Calculated Common Tax Questions Answered

Your Guide To Navigating The Massachusetts State Estate Tax Law Rockland Trust

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Massachusetts Estate And Gift Taxes Explained Wealth Management

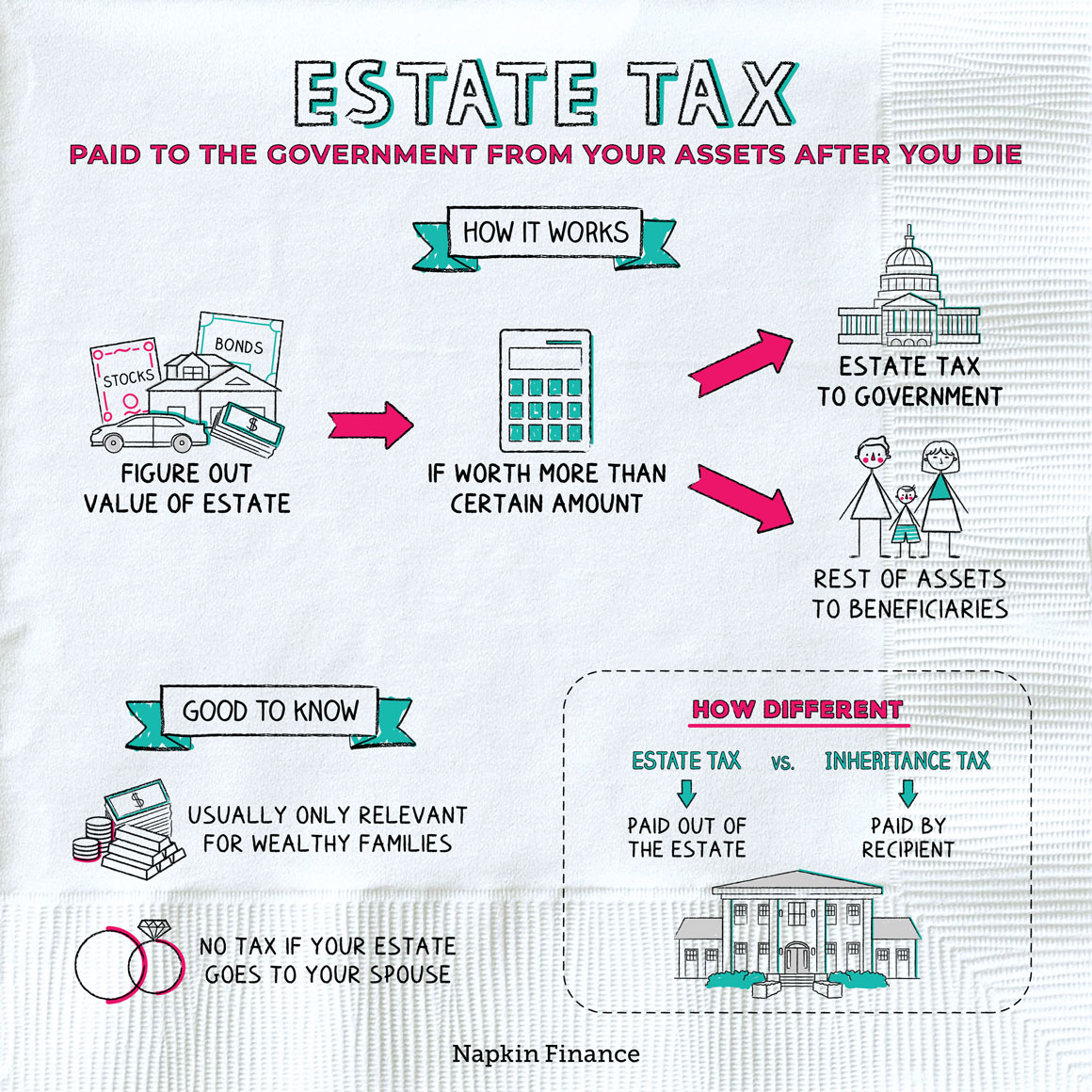

What Is An Estate Tax Napkin Finance

Massachusetts Estate Tax Everything You Need To Know Smartasset

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation